Subscribe to blog updates via email »

Summary: Balaji Srinivasan – Centralized China vs Decentralized World – The Tim Ferriss Show #547 – Love Your Work, Episode 274

What will the future look like? In his most recent November appearance on the Tim Ferriss Show, entrepreneur and investor Balaji Srinivasan presents a cohesive explanation of the current world, and plausible scenarios of how things will play out.

What will the future look like? In his most recent November appearance on the Tim Ferriss Show, entrepreneur and investor Balaji Srinivasan presents a cohesive explanation of the current world, and plausible scenarios of how things will play out.

Listen to the Podcast

WANT TO WRITE A BOOK?

Download your FREE copy of How to Write a Book »

(for a limited time)

- Listen in iTunes >>

- Download as an MP3 by right-clicking here and choosing “save as.”

- RSS feed for Love Your Work

I found Balaji’s theories so mesmerizing, I listened to the four-and-a-half-hour podcast several times, then read and took notes on the transcript. Listening to this episode was like reading a book, so – like I do with my book summaries – I wanted to improve my own understanding of the content. So, here is a podcast summarizing a podcast, in my own words.

Needless to say, the podcast is worth listening to, and since this is just a summary, you should absolutely listen to it – over on The Tim Ferris Show – to get the full context.

The decline of the nation state

One of the main forces at play in world events, according to Balaji, is the decline of nation states. He presents this idea in reference to a prescient twenty-five year-old book called The Sovereign Individual, which he cites in this podcast appearance and others.

Since the nation state is declining, it is becoming increasingly difficult for countries to control their citizens. When it’s hard to control citizens, it’s hard to collect tax revenue to fund institutions.

This loss of control is accelerating with the rise of remote work, catalyzed by the coronavirus pandemic. As more people have been able to work from anywhere, they’ve become increasingly aware of how local laws and taxes affect their lives.

The power of “exit”

The control of a nation state over its people is limited to the extent that people have the right to what Balaji summarizes as “exit.” If you’re unable to leave a place, either because the government is oppressive, or because you’re tied down because, say, you have land to tend and a flock of sheep, the government has more leeway in what policies they can enforce.

Citizens as “customers”

If people can exit their jurisdictions – whether that’s a country, a state, or a city – then citizens stop being “subjects” that jurisdictions can extract resources from, and start being “customers,” that jurisdictions want to appeal to.

We’ve of course seen this for a long time, as cities have given tax breaks or other perks to compete over companies shopping for jurisdictions in which to place their corporate headquarters. But citizens are starting to look more like customers as smaller players have exited en masse. For example, lots of people and companies have been leaving California for Texas, in search of less state control.

Balaji points out that not everyone has to exit to influence policies, but the fact that some do is tremendous leverage on any system.

Crypto entrepreneurs call New York’s bluff

An example Balaji cites of this struggle happened when New York state introduced the BitLicense – a series of regulations required for companies to do certain kinds of cryptocurrency transactions. Balaji characterizes New York’s posture in introducing these regulations as “We’re New York. What are you going to do? We’re the center of the world.”

At least ten crypto companies then left New York, including Kraken, Bitfinex, and Poloniex. In some cases they had to pack up and move. In other cases they just stopped servicing New York customers. New York apparently overestimated their leverage, and companies left for other jurisdictions, who were more accommodating to their “customers.”

Declining returns on state violence

Something Balaji doesn’t talk about much but that is a major theme in The Sovereign Individual – and is relevant to the decline of state control – is declining returns on violence, at least at the state level.

You can think of a nation state as a collection of people who contribute taxes in exchange for protection. Serfs used to pay, to their feudal lords, the returns of farming on their plots of land, in exchange for protection. Businesses in organized-crime-controlled neighborhoods pay a fee to the mob so their businesses won’t “burn down.” U.S. taxpayers pay taxes, the U.S. keeps a strong military that defends the interests of those taxpayers, and protects U.S. taxpayers’ green-bill privilege by ensuring the U.S. dollar remains the world’s reserve currency.

A relevant observation that stands out to me: Sapiens author Yuval Noah Harari once essentially said that wars used to be about control over natural resources. You can invade a country and get control over such resources, and maybe even control over labor. But China can’t invade Silicon Valley, force all the engineers and entrepreneurs to work, and by doing so extract the resources there. That’s a decline in the returns on violence, on the state level at least.

Centralized China vs. decentralized world

The main conflict Balaji sees playing out in twenty to forty years is between “centralized China” and “decentralized world.” China is a nation-state, and one of the main forces at play is the decline of the nation state, so how does that work?

What is centralized China?

As Balaji describes it, China is the most centralized government. It has “root” access to everything – much like you have over your computer if you have the root password. We’re seeing that in the coronavirus pandemic: If there’s a couple cases in a city, China can and will shut down everything, and they have total surveillance over their citizens.

This high degree of centralization will be, according to Balaji, an advantage in the short- and medium-term. It’s been an advantage in the coronavirus pandemic. I think the implication is that in an interconnected world with so much technological power, being highly-centralized is the only way for a government to retain control over its citizens, and thus extract resources to keep itself running.

How do we get to “decentralized world?”

If Balaji thinks it will take twenty to forty years for China’s centralized model to cease being an advantage, that implies that a “decentralized world” will emerge as an opposing force within that twenty to forty years.

So as less-centralized governments lose the ability to stay together and fund themselves from their citizens, that will fragment into smaller jurisdictions – sometimes based upon geography, other times based upon ideology.

From that no-doubt messy process would emerge new models for organizing people and resources. These new models would rise to become so much better that they rival the reigning world power in this scenario – China.

Sidenote from me on guns, germs, and innovation

The idea of fragmented jurisdictions competing and developing “better” models makes me think of the theories presented by Jared Diamond in Guns, Germs, and Steel. Diamond theorizes that Europe came to dominate the West hundreds of years ago because Europe had itself fragmented into many competing nation states.

Europe’s east-west orientation also meant new methods of agriculture or livestock management easily travelled from one jurisdiction to another. If a new method was developed in Spain, it could be used in France. Those two nation-states would then compete to improve that method, along with other neighboring countries, and any improvements could easily be traded back and forth, thus optimizing a “better” method.

(I say “better” in air quotes because obviously European dominance of the West is morally unsavory. Their methods were “better” merely from a game-theory standpoint: If there is one playing field – in this case, the world – the player with Europe’s set of characteristics probably gains control over that playing field in most scenarios. Other methods could be considered better, depending upon by what criteria you rate them.)

Since agricultural technology was so important to the success of a nation at that stage of global development, the portability of technology depended a lot upon climate – thus Diamond’s theory that continents with long east-west axes, and thus similarity in climates amongst jurisdictions – innovated rapidly. But in a world where innovation in digital technologies is so important, technological innovations are more portable, and so an idea can be iterated upon and improved within every jurisdiction in the world.

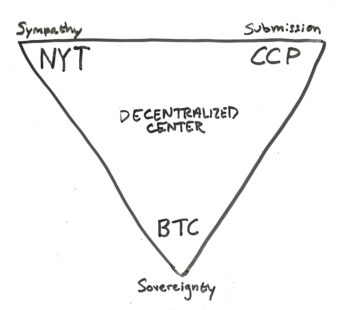

The three-way struggle for power: woke capital, communist capital, crypto capital

Balaji presents a theory of three forces that are and will continue to be struggling for power over the coming decades. I think the implication here is many “jurisdictions” will emerge with various levels of these values. As these jurisdictions compete, some will emerge as “winners” that collectively act as a “decentralized world,” which competes with centralized China.

Those three forces are: woke capital, communist capital, and crypto capital. The three organizations that represent each of these, respectively are: The New York Times, the Chinese Communist Party, and Bitcoin.

A little more about each of these:

- Woke Capital: As embodied by NYT, says, “you should sympathize.”

- Communist Capital: As embodied by CCP, says, “you should submit.”

- Crypto Capital: As embodied by BTC (or Bitcoin maximalists, in its extreme), says, “you should be sovereign.”

Both woke capital and crypto capital essentially say “you are powerful…” But woke capital finishes that sentence with “…and you should apologize for that power.”

Crypto capital finishes “you are powerful…” by saying “…and you should be self-sufficient.”

Communist capital instead of “_you_ are powerful,” says “_we_ are powerful…” but, like woke capital, encourages a posture of submission or bowing down as you make yourself subservient to that power. Crypto capital on the other hand encourages a confident posture with head held high.

An optimal “decentralized center”

Any of these forces taken to their extreme is bad. Different jurisdictions will embody different mixes of these values, and, Balaji hopes, we’ll reach an optimal “decentralized center.” We’ll hopefully have a decentralized world, with a good mixture of concern for one’s fellow human, self-sufficiency and personal responsibility within the populace, and some degree of control by competent leaders and organizations who are qualified to make decisions for large swaths of people.

State-controlled press, or a press-controlled state?

The New York Times, and the American press at-large, seem to be the incumbents in America, and maybe it’s because Balaji leans toward crypto capital himself – he’s the former CTO of Coinbase – that he spends a good portion of the conversation criticizing the press.

A resonant quote Balaji says is common: “If China’s got a state-controlled press, America’s a press-controlled state.” In other words, in China, politicians fire journalists. In the U.S., journalists get politicians fired.

Are journalists competent?

If journalists have so much influence over politics, Balaji poses the question, Why isn’t the U.S. establishment led by more competent people? The media has so much influence over American politics, our remaining leaders are those who are best at using the media to gain power, not those who are actually competent in their domains.

By contrast, Balaji says, the Chinese system is led by people who think more like Venture Capitalists or technologists. They can think ahead and plan for various scenarios. He cites China’s decision to block outside social media companies starting way back in 2009 as prescient, probably preventing an Arab Spring-like uprising.

Since the U.S. establishment do not think like VCs or technologists, they don’t actually know how the world works. So everything is a surprise. As Balaji says, “the U.S. establishment [is] always behind the eight ball. Lehman is a surprise. Bear is a surprise. COVID is a surprise. Trump is a surprise. Afghanistan’s a surprise. Everything is a surprise.”

He presents as examples various article titles by American journalists, such as “Why Facebook Will Never Make a Significant Profit,” “Amazon.bomb,” or “Google’s Toughest Search is for a Business Model.” He says, “These journos are not off by 50 percent. You can’t just read their article and think you’re being sophisticated by discounting it. Their mental model of the world is often off by 10,000 or a hundred thousand X.”

Yet news organizations, which are for-profit endeavors, advertise themselves as arbiters of facts. Fox News used the tagline, “fair and balanced.” The Washington Post’s masthead says, “Democracy Dies in Darkness,” and The New York Times ran a billboard in Times’ Square that just said “Truth.”

Russell’s conjugation

A weapon in the struggle amongst the forces of woke, communist, and crypto capital is Russell’s conjugation, also known as emotive conjugation.

Russell’s conjugation is using different words, with different emotional valence, to describe the same thing. When philosopher Bertrand Russell talked about it on a BBC broadcast in 1948, he used the example, “I have reconsidered the matter, you have changed your mind, he has gone back on his word.”

Balaji uses the example, “he doxes, she leaks, but the New York Times investigates,” pointing out that newspapers are essentially for-profit intelligence agencies. An average person can’t just dig through somebody’s trash and put them under surveillance, but that’s what newspapers do.

Obviously anyone can use Russell’s conjugation, but since the media has so much power to shape our conception of reality it’s especially dangerous in their hands. (If the idea of the media shaping our reality is news to you, read my summaries of media theory books such as Understanding Media, The Image, and Amusing Ourselves to Death).

An example Balaji cites of Russell’s conjugation in action is that the New York Times, in 2012, published an article called “How Punch Protected the Times”, about how dual-class stock helped keep the newspaper in the hands of the Sulzberger family. But in 2019, they criticized Facebook’s use of dual-class stock by publishing “You Can’t Fire Mark Zuckerberg’s Kid’s Kids”. (To be fair, they were both opinion columns.)

Will the U.S. seize Bitcoin?

The main force that will lead the move toward decentralization is Bitcoin. But will Bitcoin keep growing in influence, or will it be made irrelevant?

Since China recently cut off mining of Bitcoin within their borders, Balaji says it’s unlikely there will be a successful technical attack on Bitcoin. China was the biggest potential threat on that front, and Bitcoin survived.

Threats to Bitcoin

There’s still some possibility of software attacks, such as a “zero day” attack, a very popular client having a vulnerability, a supply chain attack in which a library is included in the code and isn’t caught, or quantum decryption being developed before quantum encryption.

One potential threat to Bitcoin is the U.S. government seizing Bitcoin, much like F.D.R. did with gold in 1933. With executive order 6102, F.D.R. made it illegal to “hoard” gold coins, bullion, and certificates (which I notice was a nice Russell conjugation: Instead of “hoarding,” he could’ve called it “saving.”) Everyone had to turn in their gold, in exchange for a low, fixed price, so the Federal Reserve could issue more gold-backed money. Could the government do the same for Bitcoin?

History running in reverse

Balaji considers this an unlikely scenario, or at least a scenario unlikely to be successful, because “history is running in reverse.” That is, in 1933, the world was moving toward centralization, and today, the world is moving away from centralization.

Balaji sees the peak of centralization as 1950, when there was one telephone company (AT&T), two superpowers (U.S. and U.S.S.R.), and three television stations (ABC, CBS, and NBC). Moving toward that, the Western frontier closed, the Spanish flu pandemic spread, there was the rise of the “robber barons” and private banking, the right and left were fighting in the streets, and inflation ran rampant in Weimar, Germany. Moving in reverse, we have the internet frontier opening, the COVID pandemic, the rise of tech billionaires and crypto, the right and left fighting in the streets, and what Balaji describes as “Weimar, America,” with accelerating inflation. Additionally, in 1933, F.D.R. had the world’s smartest people helping him in his Brain Trust. Today, the smartest people are no longer working with the government.

So, Balaji feels that if the U.S. were to attempt to seize Bitcoin, they wouldn’t be able to pull it off, because history is running in reverse. I’ll add that it seems that would be a tough thing to justify to the public. Executive order 6102 was at least ostensibly for the purposes of making sure the currency was backed by enough gold. I struggle to imagine a palatable justification for seizing Bitcoin from private citizens.

The DeFi Matrix

A big idea Balaji talks about and that Tim Ferriss agrees is a big idea is the “DeFi Matrix.” Turning an asset into money is called a “liquidity event,” because money is a liquid asset. But, increasingly, every asset can simply be traded directly for another asset, on the DeFi Matrix. For example, it’s extremely easy to exchange any cryptocurrency for any other cryptocurrency.

Supposedly, the DeFi Matrix will make it possible to price things we couldn’t price before. Balaji uses examples such as a megabyte on your hard drive, a JPEG, or a minute of your time (which I already do on Clarity.fm). He describes this as being like when every newspaper went online and Google News was indexing all of them. Suddenly they were all competing against each other, and local newspapers that were just syndicating AP stories couldn’t compete anymore.

Bitcoin as a world government

Are you struggling to see the connection there? If all assets can be exchanged directly for one another, then currencies are no longer dependent upon geography. Suddenly, smaller countries such as Switzerland, Singapore, or Dubai, have an opportunity to compete with their currencies on a global scale. They can add privacy features or Bitcoin backing. So even if you don’t trade a megabyte on your hard drive directly for a cup of sugar, you can at least more-easily choose what liquid currency you convert to.

This makes Bitcoin as like a world government, placing a constraint on every state. If a country spends more than they have, people who hold the currency can “exit” to BTC, or the DeFi Matrix.

Honorable mention

I’ve covered the main thread of this conversation, but it’s extremely wide-ranging, and this summary is of course no substitute for actually listening to the conversation.

Some ideas I’d like to give honorable mention, which you’ll learn more about if you listen to the episode, are:

- Bitcoin as a “money battery,” that uses the surplus of renewable energy sources

- Blockchain explorers as the stealth threat to search engines

- How data becomes money when stored on the blockchain, thus making blockchain companies more secure

- How data stored on the blockchain makes it difficult to spread falsehoods

- What it means to be a “capital allocator,” and why we need more of them

- The principle/agent problem, and how automation will relegate management to the arrangement of automation

- Unbundling and rebundling

- Why San Francisco is like a terrible product with great legacy distribution

- How city coins will turn NIMBY into YIMBY

- Bitcoin as a parallel to the Protestant Reformation

There you have it. I wish I knew enough to intelligently disagree with Balaji somewhere, but I personally wanted to digest the conversation, as it’s a wide-ranging and cohesive picture that gives the appearance of being correct. Go listen to the full episode to learn more.

Image via Flickr: TechCrunch

Mind Management is a Kindle Deal!

Amazon has hand-selected Mind Management, Not Time Management for a promotional discount. It’s only $2.49 on Amazon.com and Amazon.ca. Offer ends March 31st, so grab it now!

Join the Patreon for (new) bonus content!

I've been adding lots of new content to Patreon. Join the Patreon »

Subscribe to Love Your Work

Listen to the Podcast

- Listen in iTunes >>

- Download as an MP3 by right-clicking here and choosing “save as.”

- RSS feed for Love Your Work

Theme music: Dorena “At Sea”, from the album About Everything And More. By Arrangement with Deep Elm Records. Listen on Spotify »