Subscribe to blog updates via email »

The Black Swan Book Summary – Love Your Work, Episode 244

If you want to write a book, don’t ask, “How much money does the average book make?” In this context, “average” is meaningless. You’re in the world of Black Swans. The Black Swan is a book by Nassim Nicholas Taleb, and I have found the ideas in it critical to navigating my career as an author. Here – in my own words – is my The Black Swan book summary. The ideas in The Black Swan: The Impact of the Highly Improbable are what I think about when I’m considering writing a new book.

If you want to write a book, don’t ask, “How much money does the average book make?” In this context, “average” is meaningless. You’re in the world of Black Swans. The Black Swan is a book by Nassim Nicholas Taleb, and I have found the ideas in it critical to navigating my career as an author. Here – in my own words – is my The Black Swan book summary. The ideas in The Black Swan: The Impact of the Highly Improbable are what I think about when I’m considering writing a new book.

Want to read this summary on your favorite ereader? Download it here »

Listen to The Black Swan book summary

- Listen in iTunes >>

- Download as an MP3 by right-clicking here and choosing “save as.”

- RSS feed for Love Your Work

Where does the term “Black Swan” come from?

Imagine a world where you’ve only ever seen white swans. If someone asked you whether or not black swans existed, you might say no.

You’ve seen thousands of swans, and they’ve all been white. Therefore, black swans don’t exist.

You’ve mistaken an absence of evidence for evidence of absence. Just because you haven’t seen evidence of black swans, does not prove they don’t exist.

What is a Black Swan?

A positive Black Swan: In 2010, I wrote a blog post. That blog post prompted a publisher to reach out to me. I got a book deal.

A negative Black Swan: A Las Vegas casino had an insurance policy. They protected against every cheating scenario they could imagine. They had the most popular show in Vegas, where magicians worked with giant live tigers. So they protected against the scenario of a tiger jumping into the audience. But they never imagined the tiger would maim one of the performers – Roy of Siegfried and Roy. Siegfried and Roy lost their careers. The casino lost $100 million.

Both of these incidents are Black Swans:

- Black Swans are outliers: They’re not what we expect. Nothing in the past predicts a Black Swan.

- Black Swans have extreme impact: The impact could be positive, such as my book deal, or negative, such as the tiger attack, or the terrorist attacks of 9/11.

- We backwards-rationalize Black Swans: After a Black Swan happens, it seems obvious. We look back and come up with explanations for how it happened. This gives us the illusion that Black Swans are explainable and predictable.

Note: COVID-19 is not a Black Swan. As Taleb has explained, global pandemics happen regularly. They’re uncommon, but they’re inevitable, and we know that.

The Black Swan Turkey

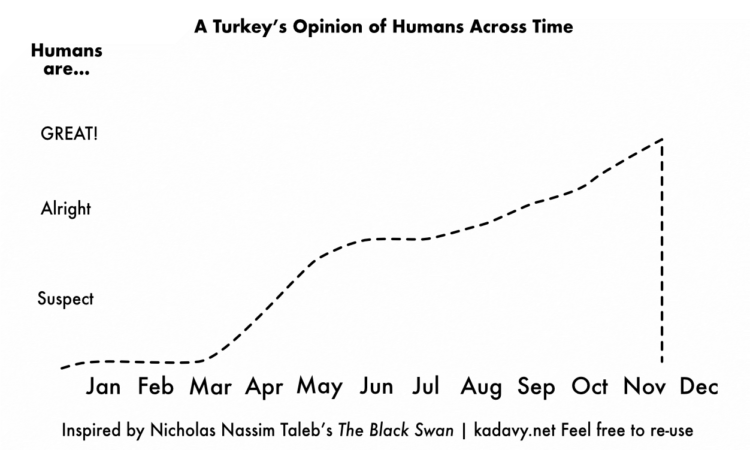

Imagine you’re a Turkey. Every day, humans come and feed you. You think humans are pretty good and nice. Each day you get new information to confirm this belief.

A graph of your opinion of humans might look like this:

Notice the sharp drop-off at the end. That’s the day before Thanksgiving. Things seemed good, until they weren’t.

History does not always predict the future. Events come along that shatter all assumptions we’ve made based upon past information.

Mediocristan vs. Extremistan

Black Swans happen in a place Taleb calls “Extremistan.” Extremistan is the opposite of “Mediocristan.”

There’s a joke I like, “Bill Gates walks into a bar. On average, everyone there is a millionaire.” We’re attracted to the “average” and the predictable. But oftentimes the concept of “average” is misleading.

Some things happen in Mediocristan and are predictable. The “average” is meaningful in Mediocristan. Other things happen in Extremistan and are unpredictable and extreme. The “average” is meaningless in Extremistan.

Mediocristan is about “the collective, the routine, the obvious, and the predicted.” Mediocristan is about risk spread out amongst many, to avoid surprises. An hourly-wage job at Starbucks is possible only in Mediocristan.

Extremistan is about “the singular, the accidental, the unseen and the unpredicted.” It’s where the Black Swans happen: random events you never expected, caused by forces you’ll never understand. Such as I experienced suddenly getting a book deal or working with a company that sold to Google.

Mediocristan is about variables that fall within a predictable range. In the history of humanity, there’s never been a man 100 feet tall, or a woman 2,000 years old. Nobody has even come close to these extremes. Height and life expectancy follow a bell curve.

![A bell curve. (Source: D Wells, Wikimedia Commons) [https://commons.wikimedia.org/wiki/File:Standard_Normal_Distribution.png]](http://kadavy.net/wp-content/uploads/2020/10/1280px-Standard_Normal_Distribution-350x216.png)

A bell curve. (Source: D Wells, Wikimedia Commons)

![Distribution of height. (Source: Our World in Data) [https://ourworldindata.org/human-height]](http://kadavy.net/wp-content/uploads/2020/10/distribution-1-775x550-1-350x248.png)

Distribution of height. (Source: Our World in Data)

Extremistan is about variables that scale indefinitely. There’s no known limit to how rich a person can be. The “average” net worth of a U.S. family is about $700,000. But to be richer than half of all Americans you need only $100,000. Still, Jeff Bezos has more than $100,000,000,000.

)](http://kadavy.net/wp-content/uploads/2020/10/1280px-Wealth_distribution_by_percentile_in_the_United_States-350x176.png)

Wealth distribution, by percentile, in the U.S. Jeff Bezos is 10x as wealthy as the highest point in this chart. (Wikipedia)

Why are Black Swans important?

- Understanding Black Swans can prepare you for the unexpected. If you learn about the impact that unexpected and extreme events can have, you can avoid foolish choices that expose you to negative Black Swans.

- Exposing yourself to Black Swans can make you successful. As we’ll talk about later, when you behave as if you’re in Mediocristan, you miss out on the positive Black Swans you’d find Extremistan. Businesses that thrive on Black Swans include venture capital, scientific research, and publishing.

(Note: Another reason Black Swans are important is – as I talked about in Mind Management, Not Time Management – if it’s predictable, it can be automated. Your edge as a human is not in Mediocristan where the robots are taking over. It’s in Extremistan – in doing something nobody could expect.)

Black Swan barrier: Platonicity

One way we blind ourselves from Black Swans is through what Taleb calls “Platonicity.” Named after the philosopher, Plato, “Platonicity” is our desire to define things, and to pay more attention to things that have been defined.

We create names for objects, we create terms (yes, such as “Platonicity”), and we invent nationalities.

Because we’re so focused on things we define, we miss all the messier stuff that also matters. Taleb describes it as “[mistaking] the map for the territory.” (I once wrote about a similar concept, and called it Stuff and Things.)

It’s helpful to categorize things, but it becomes a problem when we see a category as definitive, and don’t see the fuzzy boundaries between categories or revise them when we see new information that doesn’t fit how we categorize things.

We’ve seen this in the gendered bathroom debate. We broke gender down into two categories. Based on that we made two bathrooms. But we’re realizing it’s not so simple.

To be Platonic is to be top-down, formulaic, and close-minded. To be a-Platonic is to be bottom-up, open-minded, skeptical, and empirical.

The Platonification of breast milk

Doctors in the 1960s replicated breast milk in a laboratory, by replicating the components they could see in the milk (the things they had “Platonified”).

It seemed to make no practical sense for women to go through the inconvenience of breast feeding when you could just use bottles and lab-made formula.

There was an absence of evidence of what the benefits of breast milk were, and that was taken as evidence of absence of benefits. We didn’t know the full benefits of breast milk, but we assumed the components we could see were the only important parts.

It turned out children who were not breast fed were later at an increased risk of some cancers. If the mothers themselves had breast fed, they would have had a reduced risk of breast cancer.

Black Swan barrier: The Triplet of Opacity

Another way we blind ourselves from Black Swans is through what Taleb calls “The Triplet of Opacity.” Those are:

- The Illusion of understanding. We think we understand what’s going on, but the world is more complicated and random than we know.

- The retrospective distortion. We assess things after the fact, so we backwards rationalize and come up with reasons why things happened.

- The overvaluation of information. We place too much emphasis on facts – the things we can “Platonify” – which blinds us from stuff that isn’t so easy to Platonify.

How to make Black Swans happen?

Since Platonification blinds us to Black Swans, and we suffer from the illusion of understanding and the retrospective distortion, it may seem silly to try to make Black Swans happen.

You can’t engineer a Black Swan, but you can create the conditions for positive Black Swans to happen, as I talked about on episode 146.

Tinker

Top-down planning gives us the illusion of control, and keeps us in Mediocristan. Instead, tinker as much as possible, and learn to recognize opportunities when they present themselves.

Taleb says the reason free markets work is not because they give rewards or drive incentives. Rather, free markets work because they let people get lucky through trial and error. (Then we explain away the brilliant things we did to arrive at this wonderful discovery.)

Many discoveries come from searching for what you know, and finding what you didn’t expect. Europeans first learned of the American continent while searching for a route to India. I got my first book deal when I was trying to get votes for my speech proposal for a conference.

Be patient

Negative Black Swans happen suddenly, but positive Black Swans happen slowly. “It is much easier and much faster to destroy than to build.”

Black Swan discoveries take time to have an impact. The computer, the internet, and the laser all had a huge impacts, but were underappreciated after initial discovery.

Charles H. Townes was teased by his colleagues for inventing the laser, because they thought it was useless. It turned out to be important to eyesight correction, surgery, and data storage and retrieval.

Denarrate

The triplet of opacity feeds into the “narrative fallacy.” We’re wired to come up with stories of why things happen, but Black Swans happen for unknown reasons.

Taleb realized that as a stock trader, there was no way for him to get an informational edge. He realized any piece of news that came out would quickly be worked into the market price of any security. So, he stopped reading the news.

He recognized that reading the news as a stock trader would just support the narrative fallacy.

Taleb describes a study where sports bookmakers were given ten variables to predict horse races. When they were later given double the information, these bookmakers were no more accurate in their predictions – yet they were much more confident.

So Taleb decided that by reading the news he wouldn’t get an edge and he would become overconfident.

The Barbell Strategy

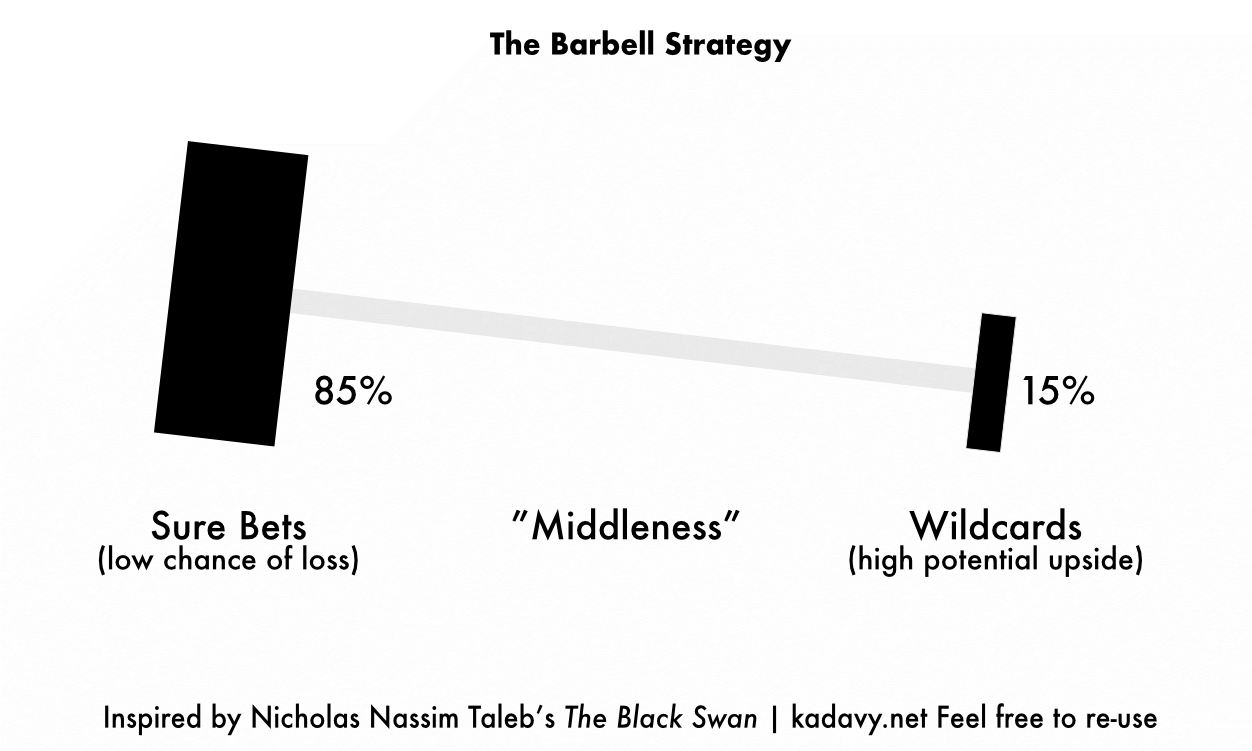

The main method Taleb recommends for protecting against negative Black Swans while exposing oneself to positive Black Swans is what he calls the Barbell Strategy.

Think of a barbell, with weights on either side. On one side of the barbell is your sure bets – things where you have little chance of losing. On the other side of the barbell is your wildcards – things with unlimited upside.

The Barbell Strategy in investing

(Note: I’m not a finance expert and nothing I’m about to say is investment advice.)

In investing, the sure bets would be treasury bills, cash, and gold. Obviously Black Swans could come along and make these bets not so sure bets, but they’re as sure as you can get.

The wildcards would be highly-leveraged option trading, angel investments, or cryptocurrency. You have a decent chance of losing your money, but there’s almost no limit to how much you can gain.

In an investing context, Taleb recommends putting 85–90% of your assets into the safe investments, and the remaining 10–15% in the speculative investments.

What you’re avoiding is the stuff in the middle. People think index funds are safe because they historically gain about 7% a year, but the entire stock market has lost up to 30% of its value very quickly. Since we’re living in an increasingly complex world, there’s no telling what kind of Black Swan could come in the future and cause an even bigger drop.

The Barbell Strategy in creative work

I hadn’t realized before reading The Black Swan that I had used the Barbell Strategy to build my creative career.

When I was first starting out, I made sure to get just enough freelance work to pay my bills. I also spent a portion of my time building passive income streams. The rest of the time, I spent tinkering and exploring my own ideas. After three years, I randomly landed a book deal to write Design for Hackers.

Dan Ariely mentioned a Barbell Strategy in my latest podcast conversation with him. He says he “gambles with his time.” He spends some portion of his time on things that don’t make sense, such as collaborating with a mentalist on-stage in one of his speeches, or working with a cartoonist.

My own Barbell Strategy has benefitted from Dan’s Barbell Strategy. A blog post I wrote as a “wildcard” – during one of my Weeks of Want – prompted Dan to reach out to me. I collaborated with him on a productivity app. We sold it to Google. That blog post also led to my third book, Mind Management, Not Time Management. (No, this is not survivorship bias.)

There’s your The Black Swan book summary!

I hope you’ve found this The Black Swan book summary useful and clear. Taleb’s writing can be confusing and even off-putting at first, but if you take the time to understand his ideas, they can help you navigate an uncertain world and find breakthrough opportunities.

I highly recommend The Black Swan. It’s one of my favorite books.

Mind Management, Not Time Management now available!

After nearly a decade of work, Mind Management, Not Time Management is now available! This book will show you how to manage your mental energy to be productive when creativity matters. Buy it now!

My Weekly Newsletter: Love Mondays

Start off each week with a dose of inspiration to help you make it as a creative. Sign up at: kadavy.net/mondays

Listener Showcase

Abby Stoddard makes the Dunnit app – the “have-done list.” It’s a minimalist tool designed to motivate action and build healthy habits.

Join the Patreon for (new) bonus content!

I've been adding lots of new content to Patreon. Join the Patreon »

Subscribe to Love Your Work

Listen to the Podcast

- Listen in iTunes >>

- Download as an MP3 by right-clicking here and choosing “save as.”

- RSS feed for Love Your Work

Theme music: Dorena “At Sea”, from the album About Everything And More. By Arrangement with Deep Elm Records. Listen on Spotify »